Make sure the SSN(s) above and on line 6c are correct. If you have a foreign address, also complete spaces below (see instructions).

#Usaa turbotax discount code zip

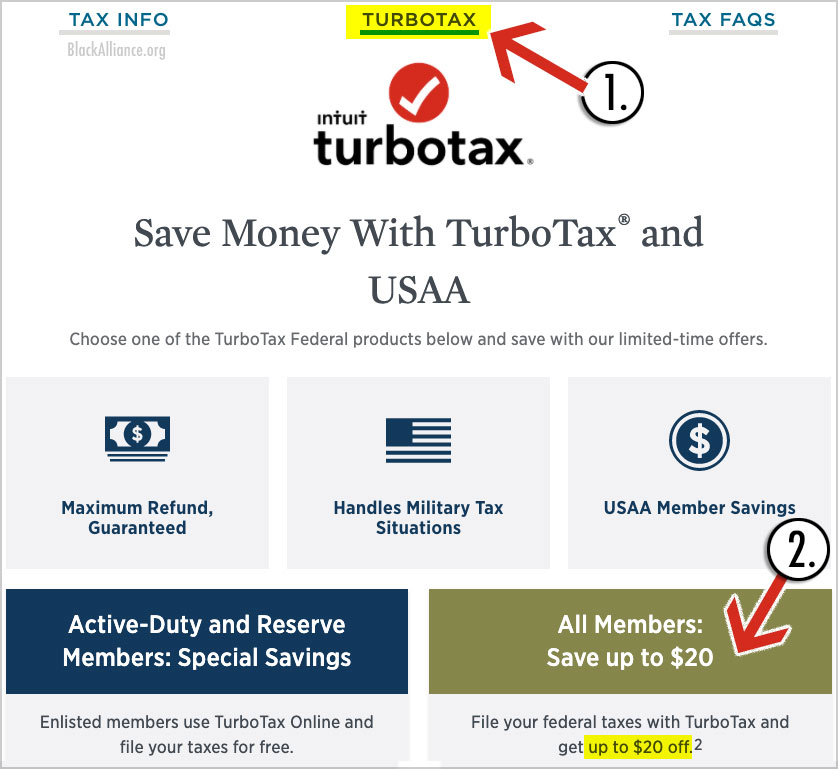

box, see instructions.Ĭity, town or post office, state, and ZIP code. 1545-00741 IRS Use Only-Do not write or staple in this 31, 2015, or other tax year beginning Your first name and initial If a joint return, spouse's first name and initialġ 0M B No. Form 5329 (Additional Taxes on Qualified Plans and Other Tax-Favored Accounts)ĭepartment of the Treasury-Internal Revenue Serviceįor the year Jan.Form 4972 (Tax on Lump-Sum Distributions).You will use information from Form 1099-R when completing IRS form 1040 or 1040A, and you may also need to report it on one or more of these IRS forms: Recharacterization refers to the treatment of a contribution to one type of IRA as having been made to a different type of IRA, or to the treatment of a conversion to a Roth IRA as though it had not occurred. Conversions and recharacterizations are also shown on Form 1099-R.Ī conversion is a distribution of money from a traditional, SEP or SIMPLE IRA that is rolled over to a Roth IRA. IRAs (Traditional, Roth, SEP and SIMPLE) įorm 1099-R is delivered to shareholders who had total or partial distributions throughout the year from these types of accounts.The Form 1099-R you receive from USAA IMCO provides information to you and the IRS regarding distributions from your: Consult your tax and legal advisers regarding your specific situation. This document is not legal, tax, or investment advice. TurboTax is a registered trademark, and TurboTax Online is a service mark of Intuit Inc. access other tools and information to answer general tax questions and help you complete your tax return.read articles on recent tax law changes.receive a discount on your Federal filing using TurboTax® online.

#Usaa turbotax discount code how to

The information in this brochure is not legal or tax advice.

If applicable to any of your USAA accounts above, you may have received form(s) 1099-R, 1099-Q or 1099-SA. The way the IRS treats distributions from your investments.ĭescriptions and explanations of tax forms related to your investments. Methods used to determine reported distributions from your investments.

0 kommentar(er)

0 kommentar(er)